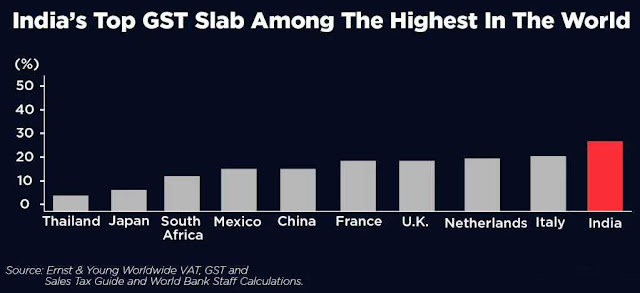

India's new brought together Goods and Services Tax, which subsumed a web of center and state tax to make life simpler for businesses, is a standout amongst the most perplexing and has the second highest rate on the world.

There are just five countries in the world including India which have at least four or more tax rates of GST, as indicated by the World Bank's half-yearly India Development Update. Most nations have either a maybe a couple rates. Different nations with at least four rates are Italy, Luxembourg, Pakistan, and Ghana. Not only that, Indian GST's best piece of 28 percent is the second highest of the 115 nations that World Bank compared.

India's landmark tax reform was headed toward a disorderly begin in July after about two many years of endeavors. A GST board, containing center and state finance ministers, thought over the rates and the instrument of usage over various meetings.

The tax upgrade brought along some getting teeth issues and interruptions. Dealers loaded up on stock and reduced production, pulling down development to a three-year low. Those issues have since slowly subsided and the economy has recuperated. Revenue collections have endured a shot, however. India missed its monetary deficiency target on this year, which the finance minister said, was on the grounds that it needed to work with 11 months of duty income as GST is gathered with a month's lag.

The World Bank said India's limit for GST enrollment is additionally the most astounding. Organizations with a yearly turnover of Rs 1.5 crore fall under the GST administration and are qualified to get input impose credit. Those with yearly deals underneath that and over Rs 20 lakh are permitted to pay a level assessment rate of one percent, however, can't charge GST on deals or receive impose credits. That is basically to facilitate the cost of consistency for independent ventures.

GST's homecoming has likewise been joined by state organizations encountering disturbances, World Bank included. "This incorporated an absence of lucidity on cessation of nearby duties; requests for exceptions or lower charge rate; and because of methods for dealing with stress to save income accumulations."

There have likewise been reports of an expanded regulatory duty consistence load on firms and a locking up of working capital because of moderate assessment discounts, the World Bank noted.

The way to GST's prosperity, as indicated by the World Bank, would be a strategy outline that limits consistency trouble by decreasing the number of various rates, constraining exceptions and disentangling laws and techniques. A nuanced correspondence crusade, it stated, is likewise vital to pass on the different parts of the new duty administration to organizations.

There are just five countries in the world including India which have at least four or more tax rates of GST, as indicated by the World Bank's half-yearly India Development Update. Most nations have either a maybe a couple rates. Different nations with at least four rates are Italy, Luxembourg, Pakistan, and Ghana. Not only that, Indian GST's best piece of 28 percent is the second highest of the 115 nations that World Bank compared.

India's landmark tax reform was headed toward a disorderly begin in July after about two many years of endeavors. A GST board, containing center and state finance ministers, thought over the rates and the instrument of usage over various meetings.

The tax upgrade brought along some getting teeth issues and interruptions. Dealers loaded up on stock and reduced production, pulling down development to a three-year low. Those issues have since slowly subsided and the economy has recuperated. Revenue collections have endured a shot, however. India missed its monetary deficiency target on this year, which the finance minister said, was on the grounds that it needed to work with 11 months of duty income as GST is gathered with a month's lag.

The World Bank said India's limit for GST enrollment is additionally the most astounding. Organizations with a yearly turnover of Rs 1.5 crore fall under the GST administration and are qualified to get input impose credit. Those with yearly deals underneath that and over Rs 20 lakh are permitted to pay a level assessment rate of one percent, however, can't charge GST on deals or receive impose credits. That is basically to facilitate the cost of consistency for independent ventures.

GST's homecoming has likewise been joined by state organizations encountering disturbances, World Bank included. "This incorporated an absence of lucidity on cessation of nearby duties; requests for exceptions or lower charge rate; and because of methods for dealing with stress to save income accumulations."

There have likewise been reports of an expanded regulatory duty consistence load on firms and a locking up of working capital because of moderate assessment discounts, the World Bank noted.

High compliance costs are also arising because the prevalence of multiple tax rates implies a need to classify inputs and outputs based on the applicable tax rate.

World Bank India Development Update

Read More: What is SGST CGST and IGST?

While getting teeth issues on the managerial and configuration sides endure, the presentation of GST ought to be "considered as the beginning of a procedure, not the end", said World Bank. The economy is adjusting to the new framework, and the GST Council has been advancing the assessment structure. "While universal experience proposes that the change procedure can influence financial action for various months, the advantages of the GST are probably going to exceed its expenses over the long haul."The way to GST's prosperity, as indicated by the World Bank, would be a strategy outline that limits consistency trouble by decreasing the number of various rates, constraining exceptions and disentangling laws and techniques. A nuanced correspondence crusade, it stated, is likewise vital to pass on the different parts of the new duty administration to organizations.

No comments:

Post a Comment